The term encompasses properties within the Portland, Oregon, metropolitan area that are utilized for business activities. These properties can include office buildings, retail spaces, industrial warehouses, and multi-family residential complexes intended for rental income. For instance, a downtown office tower leased to various companies, a shopping mall in a suburban area, or a manufacturing plant are all examples that fall under this category.

The availability and value of such properties significantly impact the local economy. They provide spaces for businesses to operate, generate employment, and contribute to the city’s tax base. Historically, the sector has experienced fluctuations in response to economic cycles, population growth, and shifts in business trends, playing a vital role in Portland’s development.

The following sections will explore current market trends, investment opportunities, key factors influencing property values, and potential future developments impacting the landscape of business-related properties in the region.

Understanding key factors is essential for success within Portland’s commercial property landscape. This section provides insights to assist stakeholders in making informed decisions.

Tip 1: Conduct Thorough Due Diligence: Prior to any investment, a comprehensive investigation of the property’s history, zoning regulations, environmental factors, and structural integrity is crucial. Engaging qualified professionals such as engineers, surveyors, and legal counsel is advisable.

Tip 2: Analyze Market Trends: The demand for different property types fluctuates. Regularly reviewing vacancy rates, lease terms, and sales data provides valuable insight into current market dynamics. Subscription to industry reports and attendance at local real estate events are beneficial.

Tip 3: Understand Zoning and Land Use Regulations: Portland’s zoning codes significantly impact permitted uses and development potential. Consulting with city planning officials and reviewing comprehensive plans helps ensure compliance and identifies potential opportunities.

Tip 4: Assess Transportation and Accessibility: Location is paramount. Evaluating proximity to major transportation arteries, public transit options, and accessibility for employees and customers influences property value and tenant appeal. Consider the impact of planned infrastructure projects.

Tip 5: Evaluate Sustainability and Energy Efficiency: Incorporating sustainable practices and energy-efficient technologies can attract environmentally conscious tenants and reduce operating costs. Pursuing LEED certification or other green building standards may offer a competitive advantage.

Tip 6: Consider Long-Term Investment Goals: Align property acquisitions with broader financial objectives. Evaluate factors such as cash flow potential, appreciation prospects, and tax implications. Seek advice from a financial advisor or tax professional.

Tip 7: Build Relationships with Local Professionals: Networking with brokers, property managers, contractors, and other industry professionals provides access to valuable market intelligence and facilitates smoother transactions. Participating in industry associations can enhance professional connections.

These strategies provide a framework for successfully navigating the sector. By considering these aspects, stakeholders can make well-informed decisions that align with their specific goals and contribute to a thriving business environment.

The final section will summarize the main points and offer concluding thoughts.

1. Market Valuation

Market valuation serves as a critical determinant in the dynamics of Portland, Oregon’s business-related property market, directly influencing investment decisions, financing options, and overall market stability. Accurate assessment of value is essential for both buyers and sellers.

- Comparable Sales Analysis

The primary method for establishing market value involves analyzing recent sales of similar properties in the vicinity. Factors considered include location, size, condition, and age. For example, if a comparable office building recently sold for \$500 per square foot, this provides a benchmark for valuing a similar property in the same submarket. The availability and reliability of comparable sales data directly impact the accuracy of valuation.

- Capitalization Rate (Cap Rate)

The cap rate, calculated as net operating income (NOI) divided by the property value, reflects the expected rate of return on an investment. A lower cap rate indicates a higher property value, and vice versa. Different property types and locations within Portland command varying cap rates based on perceived risk and market demand. For instance, a stabilized retail property in a high-traffic area may have a lower cap rate than an industrial property in a less desirable location.

- Discounted Cash Flow (DCF) Analysis

DCF analysis involves projecting future cash flows generated by the property and discounting them back to their present value. This method considers factors such as rental income, operating expenses, and potential resale value. Accurate forecasting of these variables is crucial for a reliable valuation. Changes in market conditions or lease terms can significantly impact the outcome of a DCF analysis.

- Replacement Cost Approach

This approach estimates the cost to construct a new, similar property, less depreciation. It is particularly relevant for unique or specialized properties where comparable sales data is limited. Factors such as construction costs, land values, and permitting fees influence the valuation. In a market with rising construction costs, the replacement cost approach can provide a ceiling for property values.

The interplay of these valuation methods provides a comprehensive understanding of value within the Portland, Oregon business-related property sector. Fluctuations in market conditions, interest rates, and investor sentiment can significantly impact these valuations, underscoring the importance of ongoing monitoring and professional expertise.

2. Zoning Regulations

Zoning regulations are a foundational element shaping business-related properties within Portland, Oregon. These regulations dictate permissible land uses, building heights, density, and other developmental standards, directly influencing the type, location, and value of commercial properties. A property’s zoning designation determines whether it can be used for retail, office, industrial, or mixed-use purposes, thus defining its potential revenue streams and tenant base. For instance, a property zoned for mixed-use development allows for a combination of residential and business spaces, potentially increasing its overall value and market appeal. Conversely, a property zoned exclusively for industrial use will have a different set of potential tenants and valuation considerations.

The City of Portland’s zoning code is a complex framework that impacts development and redevelopment opportunities. Understanding these regulations is crucial for investors, developers, and business owners seeking to acquire, develop, or operate business-related properties in the area. For example, height restrictions in certain zones can limit the construction of high-rise office buildings, affecting the supply of office space and driving up rental rates. Furthermore, zoning regulations related to parking requirements can significantly influence the feasibility of retail or restaurant developments, especially in dense urban areas. Compliance with these regulations is not only legally mandated but also essential for maximizing property value and minimizing potential risks.

Navigating Portland’s zoning regulations requires expertise and due diligence. Changes to zoning codes can create both opportunities and challenges for business-related property owners. Staying informed about proposed zoning amendments, comprehensive plan updates, and other regulatory changes is crucial for long-term investment success. The interaction between zoning regulations and market forces continuously shapes the business-related property landscape in Portland, making a thorough understanding of these rules indispensable for stakeholders in the sector.

3. Economic Indicators

Economic indicators serve as barometers of the Portland, Oregon, economy, profoundly impacting the performance and valuation of its business-related properties. These indicators, encompassing metrics such as employment rates, Gross Domestic Product (GDP) growth, inflation, and interest rates, provide insights into the overall economic health and future prospects of the region. A rising employment rate, for instance, signals increased economic activity, potentially driving demand for office space and retail locations as businesses expand and consumer spending increases. Conversely, a decline in employment could lead to higher vacancy rates and downward pressure on rental rates. The real estate market does not operate in isolation; it is inextricably linked to the broader economic context.

GDP growth, reflecting the total value of goods and services produced in the Portland metropolitan area, also influences property values and investment decisions. Strong GDP growth typically corresponds with increased business activity, higher corporate profits, and greater demand for business-related properties. Conversely, a recessionary environment, marked by declining GDP, can lead to decreased demand for properties and reduced investment appetite. For example, during the economic downturn of 2008-2009, the business-related property market in Portland experienced significant declines in property values and increased vacancy rates due to widespread job losses and business closures. Additionally, inflation and interest rates play critical roles in determining the attractiveness of business-related property investments. Rising inflation erodes the purchasing power of rental income, while higher interest rates increase borrowing costs, potentially dampening investment activity.

Understanding the interplay between economic indicators and the Portland, Oregon, business-related property market is essential for making informed investment decisions and managing risks. By closely monitoring these indicators and analyzing their potential impact on property values, rental rates, and tenant demand, stakeholders can better navigate the complexities of the market and capitalize on emerging opportunities. This understanding allows for strategic planning and risk mitigation in a dynamic economic environment, fostering sustainable growth and long-term value creation.

4. Location Attributes

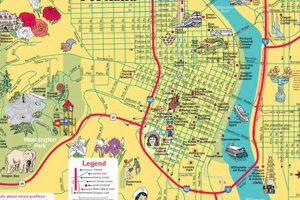

The value and utility of business-related properties in Portland, Oregon, are inextricably linked to their location attributes. These attributes encompass a range of factors that influence a property’s accessibility, visibility, and overall desirability, consequently impacting its rental income, occupancy rates, and long-term appreciation potential. Proximity to major transportation arteries, such as Interstate 5 and Interstate 84, provides logistical advantages for businesses reliant on efficient distribution networks. Similarly, properties situated near public transit hubs, including MAX light rail stations and bus lines, offer enhanced accessibility for employees and customers. The presence of nearby amenities, such as restaurants, shops, and cultural attractions, contributes to the overall appeal of a location, attracting both tenants and customers.

The specific type of business dictates the relative importance of different location attributes. Retail businesses, for instance, typically prioritize visibility and foot traffic, seeking locations on high-traffic streets or in prominent shopping centers. In contrast, industrial properties may prioritize access to transportation infrastructure and proximity to suppliers or customers. Office buildings often benefit from locations in central business districts or areas with a concentration of professional services, enhancing networking opportunities and attracting skilled employees. The South Waterfront district in Portland exemplifies how strategic planning and infrastructure investments can transform a previously underutilized area into a desirable location for business-related properties, with its combination of office buildings, residential units, and waterfront amenities.

In conclusion, location attributes are a critical determinant of value and performance in the Portland, Oregon, business-related property market. Understanding the specific needs and preferences of different types of businesses, combined with a thorough analysis of location attributes, is essential for making informed investment decisions. Changes in transportation infrastructure, demographic trends, and urban planning policies can significantly impact the desirability of different locations, underscoring the importance of ongoing monitoring and adaptation. The interplay of these factors shapes the dynamics of the market, highlighting the practical significance of location attributes in the valuation and management of commercial real estate.

5. Property Types

The diverse range of property types forms the core of Portland, Oregon’s commercial real estate market. These categories, including office buildings, retail spaces, industrial warehouses, and multi-family apartment complexes (often considered commercial due to their investment nature), each exhibit unique characteristics and respond differently to economic forces. The relative performance of each property type directly influences the overall health and stability of the commercial real estate sector in Portland. For example, a surge in tech industry employment may drive up demand and rental rates for office spaces in downtown Portland, while a decline in manufacturing activity could lead to increased vacancy rates in industrial areas like the Rivergate district.

Understanding these property types is crucial for stakeholders. The needs of businesses seeking space vary significantly. Retail businesses require high-visibility locations with ample foot traffic, whereas industrial operations need large square footage and accessibility to transportation networks. Multi-family properties cater to a different demographic, with demand affected by population growth, household formation, and housing affordability. In Portland, a trend toward mixed-use developments integrates various property types within a single project, reflecting the city’s urban planning goals and responding to the evolving needs of businesses and residents. For instance, the Pearl District showcases the successful integration of residential units, retail spaces, and office buildings, creating a vibrant and walkable urban environment. The success of these developments underscores the importance of aligning property types with market demand and urban design principles.

In summary, property types are an essential component of Portland’s commercial real estate ecosystem. The performance of each property type, and the overall balance between them, shapes the investment landscape and dictates development strategies. Monitoring trends in occupancy rates, rental rates, and construction activity across different property types provides invaluable insights for investors, developers, and policymakers, enabling them to make informed decisions and contribute to the sustainable growth of Portland’s economy. The challenges in this sector include adapting to changing consumer behaviors, embracing sustainable building practices, and managing urban density in a responsible and equitable manner.

Frequently Asked Questions

This section addresses common inquiries regarding the investment, valuation, and regulatory aspects of business-related properties in the Portland, Oregon metropolitan area.

Question 1: What factors primarily influence the valuation of commercial properties in Portland?

Valuation is primarily influenced by comparable sales data, capitalization rates, location attributes (accessibility, visibility), zoning regulations, and prevailing economic conditions within the region. Physical condition and tenant quality also play significant roles.

Question 2: How does Portland’s zoning code impact commercial development?

The zoning code dictates permitted land uses, building heights, density, and parking requirements, directly impacting the feasibility and profitability of commercial development projects. Compliance is mandatory, and understanding the code is crucial for developers.

Question 3: What are the key economic indicators to monitor for investment in Portland’s commercial real estate market?

Key indicators include employment rates, GDP growth, inflation, interest rates, and consumer confidence indices. These metrics provide insights into the overall economic health and potential demand for business-related properties.

Question 4: Which location attributes are most desirable for commercial properties in Portland?

Desirable attributes vary depending on the property type but generally include proximity to major transportation arteries, public transit access, visibility, and the presence of nearby amenities such as restaurants and shops. Location within established commercial districts is often advantageous.

Question 5: What are the primary types of commercial properties in the Portland market?

The primary types include office buildings, retail spaces (shopping centers, freestanding stores), industrial warehouses, and multi-family apartment complexes utilized for investment purposes. Each type responds differently to market forces.

Question 6: What are the potential risks associated with investing in Portland’s commercial real estate?

Potential risks include economic downturns, changes in zoning regulations, rising interest rates, increased competition, environmental liabilities, and fluctuations in tenant demand. Thorough due diligence is essential to mitigate these risks.

A comprehensive understanding of these factors is crucial for informed decision-making in the dynamic Portland, Oregon commercial real estate landscape.

This concludes the FAQ section. Please refer to subsequent sections for detailed analysis of specific market trends and investment strategies.

Conclusion

The preceding analysis has provided an overview of factors influencing business-related properties in Portland, Oregon. This includes valuation methods, zoning regulations, key economic indicators, desirable location attributes, and a classification of different property types. Understanding these elements is crucial for stakeholders seeking to navigate this market effectively.

Ongoing due diligence and adaptation to evolving market conditions remain essential for success within the realm of Portland Oregon Commercial Real Estate. The information presented here is intended to serve as a foundation for further research and informed decision-making, recognizing the dynamic and complex nature of the sector.