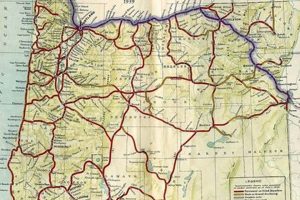

A graphical representation displaying settlements situated along the edge of Oregon’s landmass where it meets the Pacific Ocean. These cartographic tools typically illustrate the geographic location of cities, villages, and other population centers relative to natural features like beaches, rivers, headlands, and the overall shape of the shoreline. For instance, a user could consult such a resource to determine the distance between Newport and Florence, identifying intervening communities.

Utilizing visual aids focused on these coastal communities offers numerous advantages. These resources facilitate trip planning, providing context for navigation and exploration. They can highlight areas of interest for tourism, such as state parks, historic sites, and recreational areas. Historically, such representations provided critical information for maritime activities, trade, and the establishment of infrastructure along the Pacific seaboard.

Understanding the arrangement and characteristics of Oregon’s seaside communities requires delving into specific details. Further discussion will address factors influencing settlement patterns, key destinations, and how current resources can enhance the appreciation of this region.

Planning a journey to Oregon’s oceanfront demands careful consideration. Utilizing the resources that depict settlements bordering the Pacific Ocean will improve the expedition.

Tip 1: Identify Key Geographic Features: Examine the available cartography to understand the relationship between settlements and natural landmarks like headlands, bays, and rivers. This contextual awareness enhances orientation and provides insights into potential routes.

Tip 2: Determine Distances Between Locations: Accurate spatial depictions assist in estimating travel times between communities. Consider factors such as road conditions and elevation changes, which are not always evident on a simplified chart.

Tip 3: Locate Points of Interest: Identify areas of historical, cultural, or ecological significance. Integrate these destinations into a detailed itinerary to maximize the educational and recreational aspects of the journey.

Tip 4: Assess Infrastructure Availability: Review the placement of essential facilities, including lodging, dining, and fuel stations, along the planned route. Strategic planning ensures adequate resource access and avoids logistical challenges.

Tip 5: Consider Seasonal Variations: Recognize that the Oregon coast experiences diverse weather patterns throughout the year. Integrate climate considerations into the preparation process to accommodate potential disruptions or opportunities.

Tip 6: Cross-Reference Information: Supplement cartographic data with up-to-date resources from official tourism agencies, environmental organizations, and local authorities. Validating information guarantees precision and enriches travel intelligence.

Tip 7: Evaluate Scale and Resolution: Recognize that cartographic products vary in the amount of geographical detail. Select resources with appropriate scale and resolution according to the specific planning requirements of the journey.

Effective engagement with cartographic depictions of Oregon’s coastal communities leads to informed decision-making and mitigates unforeseen problems. Diligent planning ensures a more enriched and successful coastal experience.

Subsequent sections will elaborate on regional attractions, providing further details for individual itineraries.

1. Spatial Accuracy

Spatial accuracy represents a cornerstone in creating and interpreting cartographic depictions of Oregon’s coastal communities. Any deviation from verifiable, real-world measurements undermines the utility of such resources, leading to inaccurate estimations of distances, travel times, and the relative positions of settlements. For example, if the location of Cannon Beach is depicted several miles north or south of its actual geographic coordinates, individuals relying on such data for navigation could encounter significant problems when planning routes or attempting to locate specific landmarks within the town.

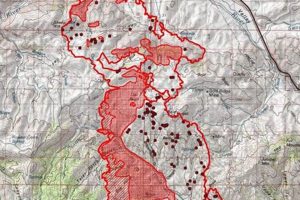

The importance of spatial accuracy extends beyond simple navigation. Emergency services rely on precise geographic information to respond effectively to incidents in coastal areas. Resource management agencies utilize accurate data for conservation efforts, land-use planning, and monitoring environmental changes. Furthermore, reliable cartography supports economic activities such as tourism, fishing, and shipping, all of which depend on accurate knowledge of locations and distances. Inaccurate positioning can have direct negative impacts on safety, economic viability, and resource preservation.

In summary, spatial accuracy is not merely a technical detail but an essential element for the practical value of visual tools representing Oregon’s coastal settlements. Maintaining high standards of spatial precision requires meticulous data collection, rigorous quality control procedures, and the integration of reliable geospatial technologies. Ignoring this foundational requirement compromises the usefulness of cartography and potentially undermines critical operations along the Oregon coast.

2. Township Locations

The precise placement of communities along the Oregon coastline is a fundamental element within any visual representation of the region. The geographic distribution of these settlements influences logistical planning, resource allocation, and understanding the historical development of the area.

- Geographic Coordinates and Mapping Precision

The representation of settlements must reflect accurate latitude and longitude data. The fidelity of township locations to these coordinates directly impacts the reliability of cartographic products. Inaccuracies, even minor, can skew distances, travel times, and perceived relationships between communities. For example, if the coordinates for Astoria are misrepresented, analyses of transportation routes or resource accessibility from that town become flawed.

- Coastal Morphology and Settlement Patterns

The physical characteristics of the Oregon coastlinebays, headlands, river mouthssignificantly influence the positioning of townships. Settlements often develop in areas offering natural harbors or access to resources. Cartography should clearly display these relationships. Consider the placement of Newport near Yaquina Bay or Tillamook at the confluence of several rivers; such features are integral to understanding their locations.

- Historical Development and Town Origins

Township locations often reflect historical factors, such as the presence of Native American settlements, early trading posts, or resource extraction sites. Cartographic tools can benefit from incorporating historical data to contextualize the establishment of these communities. For example, the inclusion of historic cannery locations near Astoria enriches the information provided.

- Accessibility and Transportation Networks

The locations of townships are intrinsically linked to transportation infrastructure, including highways, roads, and ports. Representations should illustrate the connections between settlements, highlighting major routes and potential limitations. The presence or absence of rail lines or ferry services significantly affects accessibility and should be indicated.

In summation, the accurate depiction of township locations is essential for understanding the Oregon coastline. These factors collectively inform the utility of cartographic resources for navigation, planning, and gaining a deeper understanding of the region’s development.

3. Road Infrastructure

Road infrastructure is a critical component when considering cartographic depictions of Oregon’s coastal settlements. The availability and quality of roadways significantly influence accessibility, tourism, and the overall connectivity of these communities. Representations that accurately reflect road networks are essential for planning and decision-making.

- Highway 101 and Coastal Accessibility

Highway 101, the primary north-south route along the Oregon coast, serves as the backbone of transportation. Its depiction on charts is crucial for understanding access to coastal towns. The presence of this highway enables continuous travel between settlements, whereas its absence or condition directly affects travel times and route planning. Accurately representing Highway 101’s course and connections is fundamental to its usefulness.

- Secondary Roads and Local Connectivity

Beyond Highway 101, secondary roads play a vital role in connecting smaller communities and accessing specific attractions. The display of these routes allows one to assess the level of connectivity within the coastal region. These roads often provide access to scenic viewpoints, state parks, and remote settlements that would otherwise be inaccessible. Neglecting these local networks can lead to underestimation of travel complexities.

- Road Conditions and Seasonal Considerations

The condition of roadways along the Oregon coast can vary significantly due to weather and maintenance. Accurate depiction of potential hazards, such as steep grades, sharp curves, or areas prone to landslides, is essential. Seasonal factors, such as snow or ice during winter months, can also impact road conditions. Charts that incorporate this information provide a more realistic assessment of travel conditions.

- Bridge Infrastructure and Coastal Continuity

Several bridges are essential for maintaining continuous road access along the Oregon coastline, spanning rivers and estuaries. The absence or closure of these bridges can result in significant detours. Accurate representations must show the presence and location of these bridges, as well as any weight or height restrictions that may affect travel. This information is especially critical for commercial traffic and large vehicles.

In summary, a detailed and accurate depiction of road infrastructure on cartographic displays of Oregon’s coastal communities enhances their utility for navigation, planning, and emergency response. Understanding the relationship between roadways and settlements is critical for both residents and visitors seeking to explore and access the region.

4. Landmark Proximity

Understanding the spatial relationships between settlements and notable natural or man-made features forms a vital component when interpreting representations of Oregon’s coastline. The relative location of these features to communities influences navigation, recreational opportunities, and the overall character of the region.

- Navigation and Orientation

Prominent landmarks serve as reference points for maritime and terrestrial navigation. Headlands, distinctive rock formations, or lighthouses provide visual cues that aid in determining one’s position relative to coastal communities. For instance, Tillamook Rock Lighthouses proximity to Cannon Beach serves as a navigational aid and a point of historical significance, both critical for seafaring and understanding the region’s past.

- Recreational Access and Tourism

The proximity of parks, beaches, trails, and scenic overlooks to settlements greatly influences tourism and recreational activities. Cartographic displays illustrating these relationships allow users to identify areas with high concentrations of recreational amenities. The Oregon Dunes National Recreation Area near Florence offers a prime example; its location influences the towns economy and recreational offerings.

- Environmental Considerations and Resource Management

The distance between sensitive environmental areas (e.g., estuaries, wildlife refuges) and coastal towns informs land-use planning and conservation efforts. Cartography delineates potential impact zones and highlights areas requiring specific protection. The proximity of the Nestucca Bay National Wildlife Refuge to Pacific City affects development regulations and ecological preservation strategies.

- Historical and Cultural Significance

The location of historical sites, monuments, and culturally important locations near coastal settlements provides insights into the region’s past. Such juxtapositions contextualize the development of communities and their relationship to significant events or locations. The presence of Fort Clatsop near Astoria illustrates this point, linking the town’s history to the Lewis and Clark expedition.

Therefore, analyzing the spatial relationship between landmarks and Oregon’s coastal towns contributes significantly to understanding navigation, recreational opportunities, environmental management, and the historical context of the region. The effective use of such depictions improves planning, resource management, and an appreciation of Oregon’s coastal character.

5. Resource Accessibility

Cartographic representations of Oregon’s coastal settlements gain utility when illustrating the availability of essential provisions and services. The relative proximity of towns to vital resources impacts both residents and visitors, influencing logistical planning, emergency preparedness, and overall quality of life. These visual aids serve to depict the location of fuel stations, medical facilities, grocery stores, lodging options, and emergency services relative to population centers. For instance, a map displaying the location of hospitals along the coast provides critical information for travelers and residents in need of immediate medical assistance, especially in more remote areas. The effective depiction of resource locations reduces ambiguity and enhances decision-making in various scenarios.

One practical application of resource mapping lies in disaster preparedness. In the event of a natural disaster such as an earthquake or tsunami, knowing the location of emergency shelters, evacuation routes, and supply depots becomes paramount. Visual displays highlighting these resources facilitate rapid response and mitigation efforts. Furthermore, access to fuel and provisions is often vital for evacuation, making their accurate portrayal on cartography crucial. For example, during potential tsunami warnings, maps illustrating evacuation routes and resource locations enable efficient and coordinated movements of at-risk populations to safer grounds. This integration enhances preparedness and responsiveness during critical events.

Resource accessibility, as conveyed through visual tools, serves as a foundational element for coastal community planning, tourism, and emergency response. Ensuring the accurate representation of essential service locations remains paramount in leveraging these cartographic resources effectively. Challenges related to data maintenance, changing infrastructure, and evolving demands require ongoing efforts to update and improve the accuracy of these depictions, maximizing their value in supporting Oregon’s coastal populations and visitors alike.

6. Recreational Areas

The integration of recreational areas within cartographic depictions of Oregon’s coastal communities significantly enhances the utility of these resources for both residents and visitors. Depicting beaches, parks, trails, and other recreational amenities provides a comprehensive understanding of the region’s attractions and supports informed decision-making for leisure activities.

- Identification of Coastal Access Points

Cartographic tools highlight public access points to beaches and shorelines, essential information for planning coastal excursions. These tools indicate locations with parking facilities, restroom access, and designated entry points, thereby facilitating safe and convenient access. The presence of accessible pathways for individuals with mobility challenges can also be displayed.

- Delineation of Park Boundaries and Amenities

Detailed representations delineate park boundaries and associated amenities, such as camping sites, picnic areas, and visitor centers. This enables individuals to locate and assess the suitability of various parks based on their recreational preferences. The inclusion of trail systems within park boundaries provides opportunities for hiking and exploration.

- Representation of Water-Based Recreation Opportunities

Visual aids indicate areas suitable for water-based recreation, including surfing locations, kayaking routes, and fishing spots. These depictions provide information on potential hazards, such as strong currents or submerged rocks, promoting safe participation in water activities. Access points for launching boats and kayaks are also indicated.

- Integration of Trail Networks and Scenic Overlooks

Cartographic resources incorporate hiking trails, bike paths, and scenic overlooks, allowing users to plan routes based on distance, difficulty, and points of interest. These networks connect communities to natural attractions, fostering outdoor recreation and promoting tourism. Visual aids should show elevation changes and trail conditions for informed route selection.

The comprehensive depiction of recreational areas on cartography enhances the Oregon coastal experience. These integrations allow for effective trip planning, promoting safety, and encouraging responsible enjoyment of the region’s natural resources.

7. Scale Representation

Scale representation is a fundamental aspect influencing the utility and interpretation of any graphical depiction of Oregon’s coastal settlements. It dictates the relationship between the dimensions of features on the rendering and their corresponding sizes in the real world. Incorrect or misunderstood scale can lead to flawed perceptions of distances, areas, and the relative positioning of communities, thereby diminishing the effectiveness of the representation for planning, navigation, and resource management. For example, a small-scale representation (e.g., 1:1,000,000) might depict the entire Oregon coastline on a single page, but it would lack the detail necessary to distinguish individual streets within a town or accurately assess the distance between closely situated settlements. Conversely, a large-scale version (e.g., 1:24,000) could offer extensive detail for a limited geographic area, useful for local navigation but inadequate for regional trip planning.

The practical implications of understanding scale are multifaceted. Consider trip planning: selecting an appropriate tool is crucial. A small-scale reference, while providing a broad overview, might underestimate travel times between towns due to the omission of winding roads or topographical features. Conversely, a large-scale graphical aid would enable precise route selection within a specific locale, identifying parking areas, trailheads, and points of interest. Similarly, for emergency response planning, understanding scale allows for accurate estimations of evacuation zones and the efficient deployment of resources to affected areas. Environmental agencies rely on scale to delineate habitats, monitor coastal erosion, and assess the impact of development on sensitive ecosystems. Furthermore, property assessment and land-use planning depend on accurate scaling to establish boundaries and assess spatial relationships.

In conclusion, scale representation is not merely a technical detail but a critical element that determines the information conveyed by depictions of Oregon’s coastal communities. Selecting and interpreting a graphical tool with the appropriate scale is essential for effective decision-making, resource management, and navigation along the Oregon coast. Challenges remain in ensuring consistent scale across different datasets and communicating scale effectively to non-technical users. Overcoming these challenges will enhance the usability of these depictions, fostering improved planning, environmental stewardship, and safety along the coastline.

Frequently Asked Questions

This section addresses common inquiries regarding cartographic representations of Oregon’s coastal communities. The following questions and answers provide clarity on the use and interpretation of these visual resources.

Question 1: What is the primary purpose of a graphical depiction highlighting settlements along the Oregon coast?

The principal function is to provide a spatial overview of populated areas adjacent to the Pacific Ocean in Oregon. These tools facilitate trip planning, navigation, resource management, and general understanding of the region’s geography.

Question 2: How is spatial accuracy determined in graphical depictions of the Oregon coastline?

Spatial accuracy is typically verified through the comparison of feature positions against known geographic coordinates obtained from GPS measurements, aerial photography, or satellite imagery. Discrepancies are minimized through rigorous quality control procedures.

Question 3: What features are essential to include when visually representing Oregon’s coastal towns?

Essential features include accurate township locations, road infrastructure, landmarks (natural and man-made), recreational areas, resource locations (fuel, medical), and a clear scale representation.

Question 4: How does scale impact the interpretation of settlements along the Oregon coastline?

Scale dictates the level of detail displayed and influences the perception of distances and areas. A small scale provides a broad overview, while a large scale offers detailed local information.

Question 5: What factors influence the placement of settlements along the Oregon coast?

Settlement patterns are influenced by geographic features (harbors, river mouths), historical factors (trading posts, resource extraction), accessibility (transportation routes), and economic opportunities (fishing, tourism).

Question 6: Are there specific challenges associated with creating accurate renditions of Oregon’s coastal region?

Challenges include the dynamic nature of the coastline (erosion, changing infrastructure), the need for continuous data updates, and the complexity of representing three-dimensional features on a two-dimensional surface.

The accurate interpretation and application of cartographic displays enhance understanding and informed decision-making related to Oregon’s coastal region.

The subsequent section delves into specific destinations and highlights particular points of interest along the Oregon coast.

Conclusion

The preceding discussion has examined the “map of oregon coastline towns” as a vital resource for navigation, planning, and understanding the geographic context of this region. Key points addressed include the importance of spatial accuracy, the influence of topographic and historical factors on settlement patterns, and the significance of infrastructure and recreational areas. Accurate depictions support informed decision-making and facilitate responsible engagement with Oregon’s coastal environment.

Continued investment in high-quality cartographic resources is essential for effective coastal management, disaster preparedness, and sustainable tourism. Recognizing the dynamic nature of this environment, ongoing efforts should focus on data maintenance, technological advancements, and improved accessibility to ensure these tools remain reliable and informative for future generations.