The availability of residential properties marketed for purchase within the geographical boundaries of a specific coastal community in Oregon represents a dynamic segment of the real estate market. These dwellings, ranging from modest cottages to expansive estates, are offered to prospective buyers seeking to establish residency or invest in the area.

Acquiring property in this locale presents numerous advantages, including proximity to natural amenities, potential for rental income, and long-term appreciation. The historical context of the region, characterized by its evolution from a small fishing village to a popular tourist destination, significantly influences property values and demand.

A comprehensive understanding of the factors influencing property values, the available inventory of dwellings, and the resources available to potential buyers is crucial for navigating the local real estate landscape effectively. This article will delve into these critical aspects, providing valuable insight for those considering a purchase in the area.

This section provides essential guidance for individuals seeking to acquire residential properties in Pacific City, Oregon. Careful consideration of these points can contribute to a more informed and successful transaction.

Tip 1: Engage a Local Real Estate Professional: Representation by an agent familiar with the Pacific City market dynamics is crucial. Their expertise can provide valuable insights into current market conditions, comparable sales, and potential investment opportunities.

Tip 2: Conduct Thorough Due Diligence: Prior to making an offer, a comprehensive property inspection is recommended. This should include assessments of structural integrity, electrical systems, plumbing, and potential environmental hazards. Reviewing property disclosures and title reports is also essential.

Tip 3: Secure Pre-Approval for Financing: Obtaining pre-approval for a mortgage loan demonstrates financial readiness to sellers and strengthens the buyer’s negotiating position. Comparing interest rates and loan terms from multiple lenders is advisable.

Tip 4: Assess Proximity to Amenities: Consider the property’s location relative to essential amenities such as grocery stores, healthcare facilities, and emergency services. Proximity to the beach, recreational areas, and local attractions also impacts property values.

Tip 5: Understand Local Zoning Regulations: Familiarize yourself with the zoning ordinances and building codes applicable to the property. This information is critical for determining permissible uses, potential for future development, and any restrictions on renovations or additions.

Tip 6: Evaluate Potential for Rental Income: Pacific City’s popularity as a tourist destination creates opportunities for rental income. Assess the property’s suitability for short-term or long-term rentals and research local rental market rates.

A diligent approach to property acquisition in Pacific City, Oregon, involving professional guidance, thorough research, and careful financial planning, increases the likelihood of a successful and rewarding investment.

The following sections will explore financing options and legal considerations relevant to real estate transactions in the area.

1. Market Valuation

Market valuation, in the context of available residential properties in Pacific City, Oregon, represents a critical determinant of investment potential and the feasibility of acquisition. Understanding the principles governing property valuation is essential for both buyers and sellers seeking to engage in real estate transactions within this specific geographic locale.

- Comparable Sales Analysis

This method involves examining recent sales data for similar properties in the Pacific City area. Factors such as square footage, lot size, number of bedrooms and bathrooms, and proximity to amenities are considered. The adjusted sales prices of these comparable properties provide a benchmark for estimating the value of the subject property. For example, a house with an ocean view and direct beach access will generally command a higher valuation than a similar property located further inland.

- Cost Approach

This valuation technique estimates the cost of constructing a new, equivalent structure on the subject property, minus any accrued depreciation. This approach is particularly relevant for newer properties or those with unique architectural features. Land value is also factored into the calculation. The cost approach can provide an upper limit on property value, as a buyer would typically not pay more for an existing structure than the cost of building a new one.

- Income Capitalization Approach

Applicable primarily to properties with rental income potential, this method estimates value based on the net operating income (NOI) that the property is expected to generate. The NOI is divided by a capitalization rate, which reflects the perceived risk and return expectations of investors in the Pacific City rental market. Properties located in high-demand tourist areas, capable of generating substantial rental income, will typically have higher valuations under this approach.

- Market Sentiment and Economic Factors

Broader economic conditions and investor sentiment can significantly influence property valuations. Factors such as interest rates, inflation, employment rates, and tourism trends can impact demand for residential properties in Pacific City. A strong local economy and a thriving tourism sector tend to drive up property values, while economic downturns can lead to price declines.

The interplay of these valuation methods, alongside the specific characteristics of the properties available, shapes the dynamics of the real estate market in the area. Prospective buyers and sellers should consult with qualified appraisers and real estate professionals to obtain accurate and informed valuations, enabling them to make sound investment decisions.

2. Coastal Proximity

Coastal proximity significantly influences the value and desirability of available residential properties in Pacific City, Oregon. This factor affects property valuation, lifestyle appeal, and potential risks associated with coastal living. Its impact permeates various aspects of the real estate market in this area.

- Premium Valuation

Properties situated closer to the coastline in Pacific City command a premium valuation compared to those located further inland. This is primarily attributed to unobstructed ocean views, direct beach access, and the perceived exclusivity of coastal living. Market analysis consistently demonstrates a positive correlation between proximity to the beach and the sale price of residential properties. The desirability of these properties is further heightened during peak tourist seasons.

- Lifestyle and Recreation

Coastal proximity provides residents with immediate access to a range of recreational activities, including surfing, kayaking, fishing, and beachcombing. This active lifestyle appeal is a major draw for prospective buyers seeking a coastal retreat or a permanent residence. Homes within walking distance of the beach are particularly attractive to families and individuals who prioritize outdoor recreation and a connection with nature.

- Potential Risks and Mitigation

Coastal properties are susceptible to specific environmental risks, including erosion, flooding, and storm surge. Prospective buyers must consider these risks and the associated costs of mitigation, such as flood insurance and shoreline protection measures. Property disclosures typically outline potential hazards, and thorough due diligence is essential to assess the long-term viability of coastal properties.

- Rental Income Potential

The proximity of residential properties to the coastline significantly enhances their potential for generating rental income, particularly through short-term vacation rentals. Tourists are often willing to pay a premium for accommodations with ocean views and easy beach access. Investing in coastal properties with strong rental history can provide a significant return on investment; however, regulations governing short-term rentals must be carefully considered.

These interconnected facets demonstrate the considerable influence of coastal proximity on the appeal and value of residential properties offered for purchase in Pacific City, Oregon. While proximity offers advantages, prospective buyers must conduct due diligence to understand associated challenges.

3. Property Types

The classification of property types represents a foundational aspect when evaluating available residential opportunities in Pacific City, Oregon. Understanding the distinctions between various property types is crucial for prospective buyers seeking to align their purchase with specific needs and investment goals.

- Single-Family Residences

Single-family residences constitute the most prevalent property type, encompassing detached dwellings designed for occupancy by a single household. These properties often feature private yards, garages, and multiple bedrooms and bathrooms. In Pacific City, single-family residences may range from modest cottages to expansive beachfront homes. Their suitability for families and individuals seeking long-term residency contributes to their consistent demand.

- Condominiums and Townhouses

Condominiums and townhouses represent properties with individual ownership within a larger complex. Condominiums typically involve shared common areas and amenities, while townhouses often feature separate entrances and small yards. These property types can offer a more affordable entry point into the Pacific City real estate market. Their reduced maintenance responsibilities and potential for rental income can be attractive to certain buyers.

- Vacant Land

Vacant land represents undeveloped parcels available for residential construction. Purchasing vacant land provides buyers with the opportunity to build a custom home tailored to their specific preferences. However, it also entails additional complexities, including obtaining building permits, securing financing for construction, and managing the building process. The availability of vacant land in Pacific City is often limited, increasing its value and requiring thorough due diligence.

- Multi-Family Properties

Multi-family properties encompass buildings with multiple dwelling units, such as duplexes, triplexes, and apartment buildings. These properties can offer potential for rental income and investment diversification. However, managing tenants and maintaining the property requires significant effort and expertise. In Pacific City, multi-family properties may be subject to specific zoning regulations and occupancy restrictions.

The diversity of property types within Pacific City’s real estate market caters to a wide range of buyer preferences and financial capabilities. Each property type possesses unique characteristics and investment implications that warrant careful consideration during the purchase decision.

4. Zoning Regulations

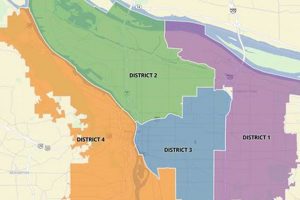

Zoning regulations represent a critical framework governing land use and development within Pacific City, Oregon. These regulations directly impact the permissible uses of properties, density of development, and architectural standards, influencing both the availability and characteristics of residential properties offered for sale.

- Permitted Uses and Residential Zones

Zoning ordinances delineate specific areas within Pacific City as residential zones, dictating the types of dwellings allowed (e.g., single-family, multi-family). Understanding these designations is crucial for prospective buyers to ensure a property aligns with their intended use. For example, a property zoned for single-family use may not be legally permissible for conversion into a duplex, impacting its potential for rental income. Variances may be sought under specific circumstances, but approval is not guaranteed.

- Density Restrictions and Lot Coverage

Density regulations limit the number of dwelling units permitted per acre of land, while lot coverage restrictions define the maximum percentage of a property that can be covered by structures. These regulations influence the size and layout of potential developments and can impact property values. A property with restrictive density limitations may limit the possibility of future expansion or the construction of additional structures, thereby affecting its long-term investment potential.

- Building Height and Setback Requirements

Building height restrictions establish maximum allowable heights for structures, often intended to preserve scenic views and maintain neighborhood character. Setback requirements dictate the minimum distance a building must be from property lines, roads, and other structures. These regulations can impact the design and placement of new construction and renovations. For example, a property with stringent setback requirements may limit the size of a new addition or prevent the construction of an accessory dwelling unit.

- Coastal Zone Management Regulations

Given Pacific City’s coastal location, properties are subject to additional regulations related to coastal zone management. These regulations aim to protect coastal resources, minimize erosion, and ensure sustainable development. Compliance with these regulations can impact development costs and restrict certain activities, such as shoreline stabilization projects. Prospective buyers of coastal properties must be aware of these specific requirements and their potential implications.

In summary, zoning regulations represent a vital consideration for anyone seeking to acquire properties in the area. Comprehending these regulations allows prospective buyers to make informed decisions, ensuring the chosen property aligns with their intended use and complies with all applicable legal requirements.

5. Investment Potential

Residential properties offered for sale in Pacific City, Oregon, inherently possess investment potential, although the degree of that potential varies considerably depending on a confluence of factors. Proximity to the coastline, property type, zoning regulations, and the overall economic climate of the region exert significant influence on the attractiveness of such properties as investment vehicles. A direct correlation exists between desirable location, well-maintained structures, and favorable zoning, on one hand, and increased rental income or resale value, on the other. For example, a beachfront cottage, properly managed as a vacation rental, can generate substantial revenue during peak tourist seasons, thereby providing a tangible return on investment.

Conversely, properties encumbered by restrictive zoning ordinances, susceptible to coastal erosion, or requiring extensive renovations may present a less compelling investment proposition. Thorough due diligence, encompassing a comprehensive market analysis, property inspection, and a review of applicable regulations, is crucial to accurately assess the investment potential. The potential for long-term appreciation must also be evaluated, considering factors such as population growth, infrastructure development, and the preservation of the region’s natural amenities. The development of new resorts or improved access to recreational activities can positively impact property values over time. Understanding the local economic forces impacting the market is necessary for informed investment decisions.

Ultimately, the investment potential inherent in dwellings marketed for purchase in Pacific City represents a complex equation, balancing inherent advantages with potential liabilities. A nuanced understanding of these factors, combined with rigorous analysis and professional guidance, is essential to maximize returns and mitigate risk. Careful consideration of factors such as market trends, property characteristics, and regulatory constraints will provide for well-informed decisions when evaluating investment properties in this region.

6. Legal Compliance

Adherence to legal statutes and regulations represents a non-negotiable aspect of real estate transactions involving residential properties in Pacific City, Oregon. Failure to comply with applicable laws can result in significant financial penalties, legal disputes, and the invalidation of property sales. The legal compliance umbrella encompasses a wide range of requirements, including but not limited to, property disclosures, environmental regulations, zoning ordinances, and contractual obligations. For example, Oregon law mandates sellers to disclose any known material defects that could affect the property’s value or safety, such as structural issues, leaky roofs, or the presence of hazardous materials. Non-disclosure can lead to legal action and financial liability for the seller.

Moreover, properties located in coastal areas, like Pacific City, are subject to specific regulations designed to protect sensitive ecosystems and manage coastal development. These regulations may pertain to building setbacks from the shoreline, erosion control measures, and the preservation of wetlands. Compliance with these coastal zone management regulations is essential to obtain necessary permits for construction or renovation projects. Ignoring these requirements can result in costly delays, fines, and potential legal challenges. Title insurance plays a crucial role in mitigating legal risks by providing coverage against title defects, liens, or encumbrances that could jeopardize ownership rights. A thorough title search and examination are essential steps in ensuring legal compliance and protecting the buyer’s investment.

In conclusion, legal compliance forms the bedrock of legitimate real estate transactions. Rigorous adherence to all applicable laws and regulations is essential for protecting the interests of both buyers and sellers, ensuring a smooth and legally sound property transfer. The complexity of real estate law underscores the importance of seeking professional guidance from experienced real estate attorneys and qualified title companies to navigate the legal landscape effectively and mitigate potential risks.

7. Financing Options

The availability and suitability of financing options directly dictate accessibility to residential properties marketed within Pacific City, Oregon. Without adequate financial backing, prospective buyers are effectively excluded from participating in the local real estate market. The array of options available, ranging from conventional mortgages to government-backed loans, influences the affordability and feasibility of acquiring dwellings in this specific coastal community. For example, first-time homebuyers may benefit from programs offered by the Oregon Housing and Community Services department, providing down payment assistance or lower interest rates. The prevailing interest rate environment also plays a crucial role, with lower rates generally stimulating demand and increasing purchasing power. Therefore, understanding the landscape of financing options is paramount for anyone seeking to own property in the region.

The unique characteristics of Pacific City, such as its coastal location and potential for vacation rentals, impact the types of financing available and the terms associated with them. Lenders may require larger down payments or impose stricter underwriting standards for properties located in areas prone to natural disasters or those intended for short-term rental use. Moreover, the availability of financing can be influenced by the property’s condition and compliance with local building codes. Properties requiring significant repairs or those not meeting current code standards may be more difficult to finance. A practical understanding of these nuances allows prospective buyers to tailor their financing strategy to the specific requirements of the local real estate market. Pre-approval for a mortgage demonstrates financial readiness, strengthening a buyer’s position during negotiations.

In conclusion, securing appropriate financing constitutes a critical step in the process of acquiring residential properties in Pacific City, Oregon. The interplay between financing options, property characteristics, and market conditions necessitates a comprehensive understanding of the available resources and potential challenges. Successfully navigating this complex landscape requires careful planning, diligent research, and the guidance of experienced financial professionals. Ultimately, informed decision-making regarding financing options serves as the key to unlocking the door to homeownership or investment opportunities in this desirable coastal community.

Frequently Asked Questions About Properties in Pacific City, Oregon

The following questions address common inquiries and misconceptions regarding residential properties marketed for sale in Pacific City, Oregon.

Question 1: What factors primarily influence property values?

Location, particularly proximity to the coastline, property size and condition, and prevailing market conditions are the primary drivers of property valuation.

Question 2: Are there restrictions on short-term rentals?

Zoning regulations and homeowners’ association rules may impose restrictions on the duration and frequency of short-term rentals. Potential investors must verify regulations prior to purchase.

Question 3: What are the common environmental risks?

Erosion, flooding, and seismic activity pose potential risks to properties situated near the coastline. Prospective buyers must evaluate and mitigate such risks.

Question 4: How does coastal proximity affect insurance rates?

Properties near the ocean typically incur higher insurance premiums due to the increased risk of storm damage and flooding.

Question 5: What types of financing are typically available?

Conventional mortgages, VA loans, and FHA loans represent the common financing mechanisms utilized for residential property purchases.

Question 6: Is a property survey necessary?

A property survey is recommended to verify boundary lines and identify potential encroachments or easements that could affect property rights.

Understanding these common inquiries is helpful for navigating the complexities of this specific real estate market. Seeking professional guidance ensures informed decision-making.

The following section will summarize key considerations for a successful purchase.

Houses for Sale in Pacific City Oregon

The foregoing examination of houses for sale in pacific city oregon underscores the complexities inherent in this localized real estate market. Key aspects such as property valuation, coastal proximity, zoning regulations, and financing options exert considerable influence on acquisition decisions. Prospective buyers and investors must prioritize meticulous due diligence, securing professional guidance to navigate the unique challenges and opportunities presented by this coastal locale.

The Pacific City real estate market represents a dynamic landscape shaped by environmental factors, regulatory constraints, and economic trends. Long-term investment success hinges upon a comprehensive understanding of these interconnected elements. Prudent navigation of these factors will determine successful property transactions and ownership within this coastal community.