Compensation provided to individuals employed by the state government of Oregon constitutes a significant area of public interest. This remuneration encompasses wages, benefits, and other forms of financial consideration extended to those working in various state agencies, departments, and institutions. For example, educators within the Oregon university system, personnel employed by the Department of Transportation, and administrative staff across diverse governmental offices all receive compensation drawn from public funds.

Understanding the allocation and distribution of these funds is crucial for ensuring governmental transparency and accountability. Analyzing the structure of these payments reveals trends in public sector employment, resource prioritization, and overall fiscal management within the state. Historical analysis of this data can expose shifts in budgetary allocations and highlight the evolution of public service compensation over time. Accessible information allows the public, policy makers, and researchers to critically evaluate resource allocation and advocate for effective governance practices.

The following analysis delves into specific aspects of public sector pay within the state, including factors influencing salary determination, methods for accessing and interpreting relevant datasets, and implications for both state employees and Oregon taxpayers. This exploration aims to provide a clear understanding of the financial landscape of state employment.

Accessing and interpreting information regarding remuneration for individuals employed by the state of Oregon requires a strategic approach. These guidelines aim to assist in effectively utilizing publicly available data.

Tip 1: Utilize Official State Resources: The Oregon Department of Administrative Services (DAS) and related agencies often provide official datasets and reports. Starting with these primary sources ensures accuracy and reduces the risk of encountering outdated or misleading information.

Tip 2: Understand Data Limitations: Publicly available data may be aggregated or anonymized to protect individual privacy. Recognize the potential limitations in granular analysis and the potential for statistical biases.

Tip 3: Clarify Position Classifications: State employment positions are categorized into specific classifications, which directly influence salary ranges. Consult the DAS classification and compensation plan to accurately interpret pay scales associated with different roles.

Tip 4: Factor in Benefits and Perks: Base salary figures represent only a portion of total compensation. Consider the value of benefits such as health insurance, retirement contributions, and paid leave, which significantly contribute to an employee’s overall package.

Tip 5: Compare Across Agencies: Salary levels can vary across different state agencies due to factors such as funding levels, geographic location, and the demand for specific skill sets. Comparisons should account for these agency-specific variables.

Tip 6: Monitor Legislative Updates: Compensation structures are subject to change through legislative action and collective bargaining agreements. Stay informed about current legislation and policy changes that may impact state employee pay.

Tip 7: Consider Cost of Living: Salary levels should be evaluated in relation to the cost of living in different regions of Oregon. A higher salary in one location may not equate to a higher standard of living compared to a lower salary in a more affordable area.

Effective utilization of information regarding Oregon state employee compensation requires a critical understanding of data sources, position classifications, and external factors. By applying these strategies, individuals can gain a more nuanced and accurate perspective on public sector remuneration within the state.

The subsequent sections will explore further aspects of Oregon’s public sector employment landscape.

1. Public Funds Allocation

The allocation of public funds is intrinsically linked to the compensation structure for employees of the state of Oregon. State government salaries are ultimately derived from taxpayer revenue, allocated through the budgetary process. The prioritization of specific agencies and departments within the budget directly influences the number of positions available and the salary levels offered within those entities. For instance, increased funding for the Department of Education may translate into additional teaching positions or increased compensation for existing educators, while reduced funding for another department may lead to hiring freezes or even salary reductions. This mechanism underscores that the overall size and distribution of public funds significantly determines the financial landscape for state employees.

Consider the impact of legislative decisions on resource allocation. If the Oregon legislature approves a significant increase in funding for mental health services, a portion of that allocation will inevitably be dedicated to staffing those services, resulting in both new employment opportunities and the potential for increased salaries for existing mental health professionals. Conversely, a decline in state tax revenue may trigger budget cuts across various departments, leading to reduced salary budgets and potential layoffs. The specific formulas and priorities established during the state’s biennial budget process, therefore, play a direct and measurable role in shaping the compensation packages offered to state employees.

In summary, the distribution of public funds is not merely a financial transaction; it constitutes a foundational element determining the livelihood and financial stability of Oregon’s state workforce. Understanding the dynamics of budget allocation provides essential context for analyzing the distribution of salaries and benefits among public sector employees. This understanding also informs public discourse surrounding appropriate levels of compensation for those serving the state’s citizenry and ensuring governmental accountability in financial management.

2. Position Classifications

Position classifications form the bedrock upon which the salary structure for Oregon state employees is built. These classifications, typically established and maintained by the Department of Administrative Services, define the duties, responsibilities, and required qualifications for specific roles within state government. A direct cause-and-effect relationship exists between a position’s classification and its corresponding salary range. Higher classifications, denoting more complex or demanding roles, are invariably associated with higher salary ranges. The importance of position classifications stems from their function in ensuring fair and equitable compensation based on the nature of the work performed. For example, a Senior Software Engineer (likely a higher classification) will receive significantly more compensation than a Data Entry Clerk (a lower classification), reflecting the difference in skills, experience, and responsibilities associated with each role.

The classification system provides a framework for establishing consistent pay scales across different state agencies. While specific salary amounts may vary slightly based on factors such as experience and performance, the underlying classification ensures that employees performing similar work are compensated within a comparable range. This consistency is vital for maintaining morale and preventing perceptions of unfairness. Practically, understanding these classifications allows current and prospective state employees to evaluate their career trajectory and potential earning capacity within the state system. They can ascertain the specific skills and qualifications needed to advance to higher-paying positions by examining the requirements for different classifications. For instance, an accountant looking to progress to a management role might review the classification specifications for a Senior Accountant or Financial Manager to identify areas for professional development.

In summary, position classifications are not merely administrative labels; they are a critical component in determining the financial well-being of Oregon state employees. They establish a clear link between job duties, required expertise, and compensation, fostering transparency and accountability in the state’s pay structure. Challenges may arise in maintaining the relevance and accuracy of these classifications as job roles evolve over time, requiring ongoing review and updates to ensure that the system accurately reflects the realities of the modern workplace. However, the underlying principle of linking compensation to job content remains essential for attracting and retaining a qualified and motivated public sector workforce in Oregon.

3. Legislative Influence

The Oregon State Legislature exerts significant control over the fiscal resources available for employee compensation. The legislative branch holds the constitutional authority to approve the state’s biennial budget, determining the allocation of funds to various state agencies and departments. This budgetary process directly shapes the financial resources allocated for employee remuneration, including both salaries and benefits. Legislative decisions on tax policy, revenue forecasts, and spending priorities ultimately determine the financial constraints within which state agencies operate and, consequently, the levels of compensation they can offer. For example, a legislative initiative to increase funding for public education will typically necessitate increased salary budgets for teachers and support staff within the public school system. Conversely, a period of economic downturn leading to reduced tax revenues may compel the legislature to implement budget cuts, potentially resulting in salary freezes or reductions for state employees. The Oregon Department of Administrative Services (DAS), responsible for managing the state’s human resources, is directly impacted by legislative directives.

The power of the legislature extends beyond the biennial budget. Statutes enacted by the legislature can also directly influence compensation policies. For instance, legislation mandating minimum wage increases applies to state employees, necessitating adjustments to the lower end of the state’s salary scales. Moreover, collective bargaining agreements negotiated between the state and labor unions representing state employees are subject to legislative approval. The legislature must ratify these agreements before they can take effect, providing another avenue for legislative influence over employee compensation. Furthermore, legislative oversight committees play a role in monitoring state agency spending and performance, including scrutiny of employee compensation practices. These committees can conduct hearings, request data, and issue reports that influence public opinion and legislative decision-making regarding employee pay.

In summary, the Oregon legislature’s power over budgetary allocations, statutory mandates, and collective bargaining agreement ratification places it at the center of determining the salary and benefit structures for state employees. This influence underscores the importance of understanding the political and legislative landscape when analyzing state employee compensation. Challenges for state employees arise when budget constraints and competing policy priorities limit available resources. The relationship between legislative decisions and employee compensation is dynamic and subject to change based on economic conditions, political priorities, and evolving public policy goals.

4. Geographic Variations

Geographic variations significantly impact the salaries of Oregon state employees. Cost of living differences across the state, particularly between urban centers like Portland and more rural areas, necessitate adjustments in compensation to maintain a comparable standard of living. Higher living expenses, including housing, transportation, and consumer goods, typically drive up salary expectations in metropolitan areas. This disparity creates pressure on state agencies to offer competitive pay in these regions to attract and retain qualified personnel. Conversely, in areas with lower costs of living, the salary requirements may be less pronounced. The effect of this differential is evident when comparing the pay scales for similar positions in different geographic locations within Oregon. A state employee working in a field office in a remote rural community might receive a lower base salary than their counterpart in a Portland-based agency, even if their job responsibilities are comparable, reflecting the adjusted cost of living.

Furthermore, the demand for specific skill sets varies geographically. Certain regions might have a higher concentration of industries requiring specialized expertise, thus increasing the market value for professionals with those skills. State agencies operating in these areas must offer competitive salaries to compete with private sector employers. For example, a state agency employing software engineers in the “Silicon Forest” region near Portland may need to provide higher compensation packages than an agency employing similar professionals in a less technologically intensive area. Moreover, geographic isolation can pose challenges for recruiting and retaining employees. Remote areas may require additional incentives, such as higher salaries or enhanced benefits, to attract qualified individuals willing to relocate or commute long distances. The state government must also address these differences as they provide services to the citizens across the state. A common approach is to analyze the labor market to provide competitive salary levels with the local and private sector of each county.

In summary, geographic variations represent a key determinant of state employee salaries in Oregon. The cost of living disparities, regional demand for specific skills, and challenges associated with geographic isolation all contribute to the need for localized compensation adjustments. Understanding these variations is crucial for ensuring fairness and equity in state employee compensation and for effectively allocating resources to attract and retain a skilled workforce across the state’s diverse regions. Failure to address these geographic influences can lead to recruitment difficulties, employee dissatisfaction, and ultimately, reduced effectiveness of state government services in certain areas of Oregon. Geographic variations should be a core element in the salaries and job market analysis.

5. Benefit Packages

The relationship between benefit packages and remuneration for Oregon state employees is integral, extending significantly beyond base wages. Comprehensive benefits constitute a substantial portion of total compensation, influencing employee attraction, retention, and overall job satisfaction. These packages commonly encompass health insurance, retirement contributions, paid leave (vacation, sick leave, and holidays), life insurance, and disability coverage. The value of these benefits, while not directly reflected in an employee’s paycheck, represents a considerable investment by the state in its workforce. For instance, a state employee with a base salary of $60,000 might receive benefits valued at an additional $25,000 to $30,000 annually, effectively increasing their total compensation by a significant margin. This necessitates considering both wages and benefits for a complete view.

The specific structure and generosity of benefit packages can serve as a competitive advantage for the state in attracting qualified candidates. Offering superior health insurance plans, more generous retirement contributions, or more extensive paid leave policies can entice prospective employees to choose state government employment over private sector alternatives, even if the base salary is slightly lower. Furthermore, robust benefits contribute to employee retention by fostering a sense of security and well-being. State employees who value their benefits are less likely to seek employment elsewhere, reducing turnover costs and preserving institutional knowledge. The Public Employees Retirement System (PERS) in Oregon is a prime example. Its structure and long-term benefits play a critical role in attracting and retaining individuals in public service. Changes to PERS benefits, whether positive or negative, can have a direct and significant impact on the state’s ability to maintain a skilled and dedicated workforce.

In summary, benefit packages are not merely an addendum to remuneration; they are a fundamental component of the total compensation offered to Oregon state employees. These packages affect attraction, retention, and job satisfaction. Their value should be carefully considered when analyzing state employee compensation. Challenges exist in balancing the cost of these benefits with the state’s budgetary constraints and in ensuring that the benefit offerings remain competitive with other employers. An ongoing assessment is required to maintain a stable and productive state workforce. The role of robust “benefit packages” as a component of “salaries of oregon state employees” can not be understated.

6. Economic Impact

The economic impact of Oregon state employee compensation is a multifaceted consideration that extends beyond the direct expenditures on salaries and benefits. These financial flows have ripple effects throughout the state’s economy, influencing a variety of sectors and affecting the financial well-being of Oregon’s communities.

- Household Spending and Local Economies

Remuneration received by state employees forms a significant component of household income, which is then injected into the local economy through spending on goods, services, and housing. In communities with a substantial state employee presence, this spending acts as a vital economic stimulus. For instance, the presence of a major state university in a rural town not only provides employment but also supports local businesses through the spending of university employees and their families. Any significant adjustments to state employee salaries directly affects the economic activity of these communities.

- Tax Revenue Generation

The salaries of Oregon state employees are subject to state and federal income taxes, contributing to the overall tax revenue generated by the state. This revenue, in turn, funds various public services, including education, infrastructure, and public safety. Therefore, the compensation provided to state employees indirectly supports the provision of essential services that benefit all Oregon residents. Higher salaries for state employees can result in increased tax revenue, allowing the state to invest further in public programs.

- Private Sector Employment

State government expenditures on goods and services, which are partially funded by tax revenue generated from state employee salaries, support private sector employment. For example, state agencies contract with private firms for construction projects, IT services, and consulting services. The funds allocated for these contracts flow to private sector companies, creating jobs and generating income for private sector employees. Consequently, the salaries paid to state employees indirectly contribute to the health and stability of the private sector.

- Retirement System Investments

A portion of state employee compensation is directed towards retirement contributions, primarily through the Public Employees Retirement System (PERS). PERS invests these contributions in a variety of assets, including stocks, bonds, and real estate, both within and outside of Oregon. The returns generated from these investments contribute to the financial stability of the retirement system, ensuring that state employees receive their promised retirement benefits. Moreover, these investments can stimulate economic growth by providing capital to businesses and developers. Sound financial management of PERS is therefore crucial for both state employee retirement security and the overall economic health of Oregon.

In conclusion, the economic impact of state government employee salaries is complex and far-reaching. From household spending to tax revenue generation, private sector employment, and retirement system investments, the compensation provided to state employees contributes significantly to the economic well-being of Oregon. Analyzing this effect requires understanding the interconnectedness of the public and private sectors and considering the long-term consequences of decisions related to employee compensation. Any changes in these parameters will affect the economic structure of the state.

7. Transparency Imperative

The transparency imperative in the context of Oregon state employee compensation dictates that the public has a right to access information regarding the disbursement of public funds, including salaries and benefits provided to individuals employed by the state. This transparency serves as a cornerstone of governmental accountability, enabling citizens, researchers, and policymakers to scrutinize resource allocation, identify potential inefficiencies or inequities, and ensure that taxpayer dollars are being used responsibly. The publication of state employee salary data fosters public trust in government operations and allows for informed decision-making regarding budgetary priorities. For example, access to salary data allows the public to assess whether compensation levels align with job responsibilities, market conditions, and overall state fiscal health. Without such transparency, questions may arise regarding potential overpayment, favoritism, or misuse of public funds, eroding public confidence in government institutions.

The practical application of this imperative involves making salary information readily available through accessible online databases, public records requests, and reports published by state agencies such as the Oregon Department of Administrative Services. These resources should provide detailed information on employee salaries, positions, and agencies, while adhering to privacy laws and regulations. In instances where salary data has been withheld or obscured, legal challenges and public pressure have often been employed to compel greater transparency. News organizations and advocacy groups play a crucial role in disseminating this information to the public, analyzing trends, and holding government officials accountable for compensation decisions. For example, when irregularities are discovered, investigative reports prompt audits, policy revisions, and disciplinary actions, reinforcing the importance of transparency as a safeguard against corruption and mismanagement. The accessibility of this data also empowers state employees to negotiate fair compensation and advocate for equitable pay practices.

In summary, the transparency imperative is inextricably linked to the administration of Oregon state employee compensation. It ensures that the expenditure of public funds is subject to public scrutiny and accountability, fostering trust and promoting responsible governance. The continuous pursuit of greater transparency faces challenges, including balancing privacy concerns with the public’s right to know and ensuring that data is presented in a clear and understandable format. Ultimately, upholding the transparency imperative is essential for maintaining a well-functioning democracy and ensuring that the salaries and benefits provided to state employees are both justifiable and equitable. The balance between these elements is crucial to the effective functioning of state services in Oregon.

Frequently Asked Questions

The following questions and answers address common inquiries regarding compensation for individuals employed by the state government of Oregon. These responses aim to provide clarity and factual information on various aspects of this topic.

Question 1: Where can salary data for Oregon state employees be accessed?

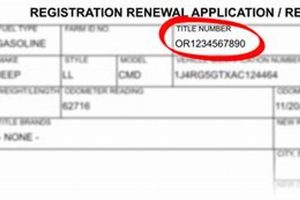

Information pertaining to remuneration for Oregon state employees is generally accessible through public records requests directed to the Oregon Department of Administrative Services (DAS) or individual state agencies. Some agencies may also publish salary data on their websites. Be aware that data may be aggregated or anonymized to comply with privacy regulations.

Question 2: What factors determine the salary range for a specific position?

Salary ranges are primarily determined by position classifications established by the Oregon Department of Administrative Services. These classifications reflect the duties, responsibilities, required qualifications, and market value of the position. Collective bargaining agreements can also influence salary scales.

Question 3: Are benefit packages included in publicly reported salary figures?

Publicly available salary figures typically reflect base wages only. The total compensation package, which includes benefits such as health insurance, retirement contributions, and paid leave, is not always readily available in publicly accessible data.

Question 4: How does the cost of living influence compensation for state employees?

The cost of living varies significantly across Oregon. State agencies may consider cost of living differences when establishing salary levels for positions in different geographic locations, particularly in high-cost urban areas.

Question 5: Who decides on salary increases for Oregon state employees?

Salary increases are determined through a combination of factors, including legislative appropriations, collective bargaining agreements (for unionized employees), performance evaluations, and merit-based adjustments approved by state agencies.

Question 6: What recourse exists if an employee believes they are being unfairly compensated?

State employees who believe they are being unfairly compensated have the right to file a grievance with their agency’s human resources department or, if applicable, through their union. They can also explore legal options if they believe they have been subjected to discrimination or other unlawful employment practices.

Understanding these aspects allows for informed analysis and evaluation of Oregon state employee compensation. Accessing primary sources and considering all relevant factors, including benefits, geographic variations, and legislative influences, contributes to a well-rounded perspective.

The subsequent analysis explores the ethical implications of “salaries of oregon state employees.”

Salaries of Oregon State Employees

This exposition has examined the multifaceted aspects of state worker remuneration in Oregon, ranging from public funds allocation and position classifications to legislative influence, geographic variations, and the critical role of benefit packages. Transparency in this domain is paramount, empowering citizens to scrutinize resource allocation and ensuring governmental accountability. The economic consequences arising from the allocation are consequential, influencing household spending, tax revenue, and the broader job market.

The continued analysis and evaluation of these financial dynamics remain essential for fostering a transparent, equitable, and efficient public sector. It is incumbent upon policymakers, state employees, and Oregon residents alike to engage in informed dialogue, striving to optimize resource allocation and ensuring the state attracts and retains a qualified workforce committed to serving the public interest. Maintaining fiscal prudence and transparency in public spending must be the guiding principles in the years ahead.