Compensation provided to individuals employed by the government of Oregon, at the state level, constitutes a significant area of public interest and financial management. These payments encompass wages, salaries, and other forms of remuneration disbursed to individuals working across various state agencies, departments, and institutions. Publicly accessible data regarding this information enables transparency and accountability in government spending.

Understanding the allocation of these financial resources is crucial for several reasons. It allows citizens to assess how taxpayer dollars are being utilized, contributes to informed decision-making during elections and budget planning, and provides insight into the state’s workforce composition. Historically, public access to government employee compensation has evolved alongside broader movements towards government transparency and open data initiatives.

The following sections will delve into the specifics of accessing this data, analyzing salary trends, and understanding the implications of state employee compensation on the overall Oregon economy.

Effective utilization of public salary data requires a focused and methodical approach. The following recommendations are designed to assist researchers, journalists, and concerned citizens in gleaning meaningful insights.

Tip 1: Identify the Specific Data Source: The State of Oregon typically provides salary information through a dedicated online portal or database. Ensure the data originates from an official government website to verify its accuracy and completeness.

Tip 2: Understand Data Limitations: The information may not include benefits, overtime pay, or other forms of compensation beyond base salary. Awareness of these limitations is critical to avoid misinterpretations.

Tip 3: Focus on Relevant Departments or Agencies: Narrowing the scope of inquiry to specific departments or agencies streamlines the analysis process. For example, focusing on the Department of Education or the Oregon Health Authority allows for targeted research.

Tip 4: Utilize Filtering and Sorting Functions: Public databases often include tools for filtering and sorting data by job title, salary range, or department. These functions enable efficient identification of specific trends and patterns.

Tip 5: Compare Salaries Across Similar Positions: Analyzing compensation for similar positions across different agencies or locations can reveal disparities and potential areas for further investigation.

Tip 6: Analyze Trends Over Time: Examining salary data from multiple years allows for the identification of long-term trends and the impact of economic factors or policy changes.

Tip 7: Cross-Reference Data with Other Public Records: Validate findings by comparing salary information with other publicly available records, such as budget documents or legislative reports. This can provide a more comprehensive understanding of the context surrounding compensation decisions.

By adhering to these recommendations, individuals can navigate the complexities of publicly available salary data with greater confidence and derive more meaningful conclusions.

The subsequent sections will explore the ethical considerations and potential policy implications associated with the public disclosure of this financial information.

1. Public Record

The designation of “state of oregon employee salaries” as a matter of public record establishes a fundamental link between government transparency and fiscal accountability. This designation mandates the open availability of salary information for Oregon state employees, facilitating public scrutiny of resource allocation and potentially influencing workforce decisions. The causal relationship is evident: the legal framework defining these records as “public” necessitates their accessibility, influencing how the state manages and justifies compensation practices. For instance, if the data reveals significant disparities between similarly positioned employees across different agencies, it could trigger audits or policy adjustments to address inequity. An example includes the media’s use of this data to analyze salary trends amongst state university presidents, leading to public discussions and, in some instances, revised compensation packages. The practical significance lies in enabling informed participation in governance and enhancing trust in public institutions.

Further, the public record aspect directly impacts collective bargaining processes and labor negotiations within state agencies. Unions leverage this information to advocate for fair wages and benefits, using comparisons across departments and positions as supporting evidence. Real-world instances show how salary data have been used to challenge alleged pay gaps based on gender or ethnicity, prompting investigations and potential corrective actions. Additionally, the open nature of this information can affect the state’s ability to attract and retain qualified professionals, as potential employees can readily compare salaries with those in other states or the private sector. The consequences of ignoring the implications of this publicly available data can range from diminished public trust to legal challenges, impacting the state’s overall administrative efficiency.

In conclusion, the intersection of public record laws and state employee salaries creates a system of checks and balances essential for responsible governance. Challenges persist in ensuring data accuracy and mitigating potential privacy concerns, but the benefits of increased transparency outweigh these risks. This access empowers the public, informs policy debates, and ultimately contributes to a more accountable and effective state government in Oregon. The ongoing dialogue surrounding this data is a critical component of maintaining public trust and promoting ethical conduct within state employment.

2. Budget Allocation

Budget allocation represents the foundational financial process through which resources are designated for various state functions, directly influencing the capacity to compensate Oregon’s public workforce. The decisions made during budget allocation have significant and measurable consequences on employee salaries and benefits.

- Legislative Appropriation and Compensation Pools

State employee compensation originates primarily from funds allocated by the Oregon State Legislature during the biennial budget process. These appropriations establish the total available funding for payroll expenses across different agencies. The size of these compensation pools directly limits the potential for salary increases, new hires, and other benefits. For example, if an agency’s budget is reduced, it may necessitate hiring freezes or salary reductions to remain within allocated financial constraints.

- Prioritization of Essential Services and Employee Needs

Budget allocation involves a continuous trade-off between various state priorities, including education, healthcare, public safety, and infrastructure. The extent to which employee compensation is prioritized relative to these other needs directly impacts salary levels and benefits packages. A scenario in which educational funding is emphasized could indirectly limit resources available for state employee pay increases across other sectors. Conversely, a stronger emphasis on public safety may result in higher salaries for law enforcement personnel.

- Impact of Economic Conditions on Salary Adjustments

Economic factors, such as state revenue fluctuations, significantly influence budget allocation decisions and, consequently, salary adjustments. During periods of economic downturn, reduced state revenue often leads to budget cuts, potentially resulting in salary freezes or even temporary pay reductions for state employees. Conversely, periods of economic growth may allow for increased investment in employee compensation through cost-of-living adjustments or merit-based raises.

- Collective Bargaining Agreements and Financial Impact

Collective bargaining agreements between the state and labor unions establish salary schedules, benefit provisions, and other compensation terms for represented employees. These agreements have a direct financial impact on budget allocation, as the state must allocate sufficient funds to fulfill its contractual obligations. Negotiated salary increases or benefit enhancements can significantly affect overall payroll costs and require careful planning within the budgeting process.

In summary, budget allocation decisions represent a complex interplay of political priorities, economic realities, and contractual obligations, all of which collectively shape the landscape of state employee compensation. These decisions have tangible effects on the financial well-being of the Oregon workforce, emphasizing the importance of transparency and accountability in the budgetary process. Understanding this relationship is essential for informed participation in discussions regarding state finance and public sector employment.

3. Job Classification

Job classification within the State of Oregon establishes a structured framework that directly governs employee compensation. This systematic process defines roles, responsibilities, and required qualifications, which, in turn, determine appropriate salary ranges. Understanding this relationship is crucial for interpreting salary data and assessing fairness in compensation practices.

- Defining Roles and Responsibilities

Job classification systems meticulously define the scope of work for each position, outlining specific duties, required skills, and levels of responsibility. This detailed description serves as the foundation for assigning the position to a specific pay grade. For example, a “Senior Software Engineer” will have a distinct job classification outlining responsibilities such as designing complex systems, leading development teams, and ensuring code quality. This defined scope directly correlates with the corresponding salary range, reflecting the complexity and impact of the role. The absence of a well-defined classification system can lead to inconsistencies in compensation, where individuals with similar responsibilities receive disparate pay.

- Establishing Pay Grades and Salary Ranges

Based on the defined roles and responsibilities, each job classification is assigned to a specific pay grade, which corresponds to a pre-determined salary range. These ranges typically reflect the market value of the skills and experience required for the position. Consider a “Budget Analyst” position classified within a specific pay grade that sets a salary range reflective of the analytical skills and financial expertise needed. The rigor and market analysis conducted to determine these pay grades directly impact the competitiveness of the State’s compensation offerings. Infrequent updates to pay grades may result in the state struggling to attract and retain talent in competitive fields.

- Impact on Career Progression and Promotion Pathways

Job classification not only dictates initial salary but also influences potential career progression within state employment. Clearly defined classifications provide pathways for employees to advance to positions with greater responsibilities and higher pay. For instance, a “Data Entry Clerk” may advance to an “Administrative Assistant” position through demonstrating acquired skills and experience, resulting in a corresponding salary increase. The transparency and accessibility of these advancement pathways contribute to employee motivation and retention. Lack of defined progression can lead to stagnation and increased employee turnover.

- Compliance with Equal Pay Laws and Regulations

A well-structured job classification system is essential for ensuring compliance with equal pay laws and regulations, preventing discriminatory compensation practices. By objectively defining roles and responsibilities, the state can minimize pay disparities based on gender, ethnicity, or other protected characteristics. For example, a rigorous job evaluation process can demonstrate that any salary differences between male and female employees in similar classifications are based on legitimate factors such as experience or performance. Inconsistencies in job classification may expose the state to legal challenges and damage its reputation.

The systematic approach of job classification to “state of oregon employee salaries” is fundamental in ensuring structured compensation practices. Through definition of responsibilities, determining pay scales, offering career opportunities, and upholding legal requirements, the classification system provides equity in the distribution of public funds and the treatment of public workers.

4. Years of Service

Longevity within state employment, commonly measured in “Years of Service,” represents a significant factor influencing the compensation structure for Oregon’s public workforce. The established relationship between tenure and salary reflects the accumulated expertise, institutional knowledge, and commitment that long-term employees bring to their roles.

- Step Increases and Salary Progression

Many state agencies utilize a step system where employees receive incremental salary increases based on their years of service. These “step increases” provide a predictable and structured path for salary progression, rewarding continued employment and experience. For example, an entry-level analyst may start at the bottom of their pay grade and gradually move up the steps with each year of satisfactory performance. This system aims to incentivize employee retention and recognize growing proficiency. However, the size and frequency of these step increases can vary across agencies, affecting long-term earning potential. The implications for the total “state of oregon employee salaries” include a predictable increase in payroll costs over time, which must be factored into budget planning.

- Merit-Based Increases and Performance Evaluation

While years of service often guarantees step increases, merit-based raises are typically tied to performance evaluations and are awarded independently. These increases recognize exceptional contributions and skill development, further influencing “state of oregon employee salaries.” High-performing employees with considerable tenure may thus receive both step increases and merit-based raises, resulting in a higher compensation level than their peers. Agencies use performance appraisals to identify and reward exceptional work. This system is incentivized to motivate employees and increase their performance.

- Pension Benefits and Retirement Eligibility

Years of service play a crucial role in determining eligibility for pension benefits and the calculation of retirement income. The Oregon Public Employees Retirement System (PERS) uses years of service as a key factor in calculating retirement benefits. Longer tenures generally result in higher retirement income. This link between years of service and retirement benefits acts as a powerful incentive for long-term state employment. The State of Oregon benefits from retaining experienced employees. However, the long-term financial obligations associated with PERS require careful management and funding.

- Vacation Accrual and Other Benefits

In addition to salary and retirement benefits, years of service often influences the accrual of vacation time and other benefits such as sick leave and health insurance options. Longer-serving employees typically accrue vacation time at a faster rate than new hires, providing them with more paid time off. This enhanced benefit package recognizes their sustained commitment and contributions to the state. As years of service accrues there are additional benefits.

The connection between years of service and “state of oregon employee salaries” involves a multifaceted system of rewards and incentives designed to attract, retain, and motivate state employees. Understanding the different facets of this connection is essential for assessing the overall cost and effectiveness of Oregon’s public workforce compensation system. The ongoing evaluation of these policies is crucial for ensuring fairness, fiscal responsibility, and a highly skilled public sector workforce.

5. Market Comparability

Market comparability serves as a crucial benchmark in determining equitable and competitive compensation levels for Oregon’s state employees. Its function is to ensure that state salaries align with those offered for similar positions in other public and private sector organizations, both within and outside the state.

- Salary Surveys and Benchmarking

Salary surveys, conducted by professional organizations and consulting firms, provide data on compensation trends across various industries and geographic locations. The State of Oregon utilizes these surveys to benchmark its salary ranges against comparable positions in other states and the private sector. For example, if a survey reveals that software engineers in the Portland metropolitan area earn significantly more than their counterparts employed by the state, adjustments may be necessary to attract and retain qualified IT professionals. The accuracy and comprehensiveness of these surveys directly impact the reliability of the benchmarking process and the effectiveness of compensation adjustments.

- Geographic Considerations and Cost of Living

Market comparability assessments must account for geographic variations in the cost of living. Salaries in urban areas with higher living expenses typically need to be higher than those in more rural locations to attract qualified candidates. For instance, state employees working in Portland may require a higher salary than those in less expensive regions of the state to maintain a comparable standard of living. Failure to consider these geographic differences can lead to recruitment and retention challenges in high-cost areas.

- Impact on Recruitment and Retention

The state’s ability to attract and retain qualified professionals is directly influenced by its competitiveness in the job market. If state salaries are significantly lower than those offered by other employers, it may struggle to fill critical positions and retain experienced employees. This can lead to increased workload on existing staff, reduced service quality, and higher turnover costs. Regularly assessing market comparability and making necessary adjustments is essential for maintaining a skilled and effective public workforce.

- Collective Bargaining and Salary Negotiations

Market comparability data plays a significant role in collective bargaining negotiations between the state and labor unions. Unions use salary surveys and benchmarking studies to advocate for fair wages and benefits for their members. The state also relies on this data to justify its compensation proposals and demonstrate its commitment to providing competitive salaries. The outcome of these negotiations directly impacts the overall cost of “state of oregon employee salaries” and the state’s ability to attract and retain talent.

In summary, market comparability ensures “state of oregon employee salaries” are not just internally consistent but also competitive within the broader labor market. Regular analysis and adjustments based on market data are vital for maintaining a qualified workforce, ensuring efficient public service, and responsibly managing taxpayer dollars.

6. Performance Metrics

Performance metrics serve as structured evaluations of an employee’s contributions and effectiveness within their role. These measurements, when systematically applied, establish a direct linkage between individual performance and compensation adjustments for state employees in Oregon.

- Key Performance Indicators (KPIs) and Salary Adjustments

Key Performance Indicators (KPIs), tailored to specific job functions, provide quantifiable measures of employee success. These metrics may include factors such as project completion rates, adherence to deadlines, customer satisfaction scores, or cost savings achieved. When consistently exceeded, pre-defined KPIs can trigger merit-based salary increases or bonuses, directly rewarding exceptional performance. For example, a state auditor who consistently identifies significant cost-saving opportunities might receive a higher salary adjustment than an auditor who meets baseline expectations. The selection of relevant and measurable KPIs is essential for ensuring a fair and effective system of performance-based compensation.

- Performance Evaluations and Merit-Based Raises

Performance evaluations, typically conducted annually, provide a comprehensive assessment of an employee’s overall contributions. These evaluations often incorporate feedback from supervisors, peers, and subordinates, as well as a self-assessment by the employee. High performance ratings can lead to merit-based raises, which are salary increases awarded in recognition of outstanding performance. These raises are typically allocated from a designated performance-based compensation pool and are distributed based on the relative performance of employees. A software developer who consistently delivers high-quality code and mentors junior team members might receive a higher merit-based raise than a developer who meets expectations but does not consistently exceed them. The rigor and fairness of the performance evaluation process are critical for maintaining employee morale and trust in the compensation system.

- Incentive Programs and Performance Bonuses

Incentive programs, designed to reward specific achievements or contributions, offer another mechanism for linking performance to compensation. These programs may involve performance bonuses, which are one-time payments awarded for achieving pre-defined goals or milestones. For example, a team of state employees working on a critical IT project might receive a performance bonus for completing the project ahead of schedule and within budget. Incentive programs can be effective in motivating employees to achieve specific objectives, but they require careful design and implementation to ensure that they align with the overall goals of the state and do not create unintended consequences.

- Disciplinary Actions and Salary Freezes

Conversely, failure to meet performance expectations can result in disciplinary actions, including salary freezes or reductions. Consistent poor performance, documented through performance evaluations and performance improvement plans, may justify withholding salary increases or even reducing an employee’s pay. For example, a state employee who consistently fails to meet deadlines or violates established policies might be subject to a salary freeze. The use of disciplinary actions as a means of addressing poor performance requires careful documentation and adherence to established procedures to ensure fairness and avoid legal challenges.

In conclusion, integrating robust performance metrics into the compensation system for “state of oregon employee salaries” promotes accountability, incentivizes high achievement, and ensures that public funds are allocated in a manner that recognizes and rewards valuable contributions to the State of Oregon. The ongoing evaluation and refinement of these metrics are essential for maintaining a high-performing and engaged public workforce.

Frequently Asked Questions

This section addresses common inquiries regarding the compensation of individuals employed by the government of Oregon. It aims to provide clear and factual responses based on publicly available information and established policies.

Question 1: Where can salary information for Oregon state employees be accessed?

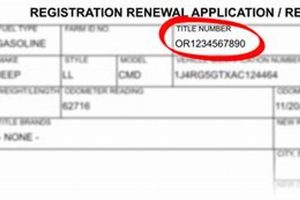

Salary data is generally accessible through a dedicated online portal maintained by the State of Oregon or its relevant agencies. The specific website address may vary, but it is typically linked from the state’s main government website under sections related to transparency or public records.

Question 2: What information is typically included in publicly available salary data?

Public salary data generally includes the employee’s name, job title, department or agency, and annual gross salary. Information regarding benefits, overtime pay, or other forms of compensation may not be included, depending on state policy and data reporting practices.

Question 3: Are there any limitations or restrictions on the use of this salary data?

While the data is publicly accessible, it must be used responsibly and ethically. It is important to avoid using the information for purposes that could constitute harassment, discrimination, or invasion of privacy. Additionally, the data should be interpreted with caution, considering the limitations of the information provided.

Question 4: How often is the salary data updated?

The frequency of data updates may vary depending on the specific agency or department. Some agencies update their salary data on a monthly or quarterly basis, while others may update it annually. It is advisable to check the data source for information on the update schedule.

Question 5: What factors influence the salary levels of Oregon state employees?

Salary levels are determined by several factors, including job classification, years of service, market comparability, performance metrics, and budgetary constraints. Collective bargaining agreements with labor unions also play a significant role in establishing salary scales and benefits provisions.

Question 6: How does the State of Oregon ensure fairness and equity in its compensation practices?

The State of Oregon strives to ensure fairness and equity through the use of standardized job classification systems, regular salary surveys to assess market comparability, performance evaluations, and adherence to equal pay laws and regulations. Ongoing efforts are made to identify and address any potential pay disparities based on gender, ethnicity, or other protected characteristics.

In conclusion, understanding the availability, limitations, and influencing factors of state employee compensation data is crucial for maintaining transparency and accountability in Oregon’s government.

The following segment will explore the potential policy implications derived from reviewing salary information of Oregon state employees.

Conclusion

The preceding analysis has provided a comprehensive overview of state of oregon employee salaries, encompassing data access, influencing factors, and broader implications. The examination revealed the interplay between public record laws, budget allocation, job classification systems, years of service, market forces, and performance evaluations in shaping compensation levels. Each element contributes to a complex system requiring constant evaluation to ensure fairness and responsible resource management.

The State’s stewardship of public funds in compensating its workforce is a matter of ongoing significance. Continuous monitoring and transparent disclosure of salary data, combined with a commitment to equitable practices, are vital for maintaining public trust and attracting qualified individuals to serve the citizens of Oregon. Continued scrutiny and informed discourse will remain essential for optimizing the effectiveness and accountability of the state’s compensation system.